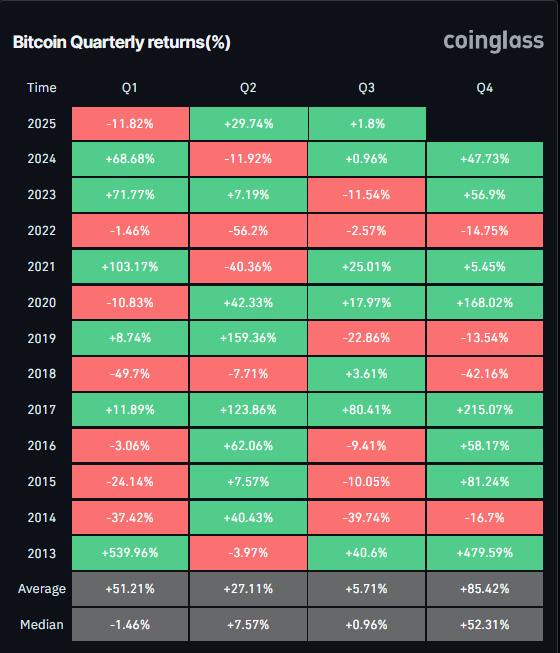

Bitcoin ended the second quarter on a high note, registering an impressive 30% increase, marking one of its best quarterly performances in recent years. Fueled by strong institutional interest, continued ETF inflows, and bullish projections from major financial institutions, the leading cryptocurrency appears poised for further upside.

🚀 Q2 Summary and Future Outlook

Bitcoin gained nearly 30% over the last three months, outperforming most traditional assets. This growth reflects increasing confidence in digital assets and rising interest from large investors. Analysts now project that BTC could reach $200,000 by the end of the year, supported by macroeconomic conditions and growing adoption.

🏢 Institutional Momentum Grows

Several major companies increased their Bitcoin holdings during Q2. One major firm added nearly 5,000 BTC to its reserves, while others followed suit with strategic purchases. This corporate accumulation signals growing trust in Bitcoin as a store of value and inflation hedge.

In parallel, spot Bitcoin ETFs have seen strong inflows for the fourth consecutive week. Total net inflows for the period reached hundreds of millions of dollars, suggesting that institutional buyers continue to accumulate Bitcoin through regulated investment products.

🌐 Global Trends and Macroeconomic Factors

On the global stage, trade developments and easing tech export restrictions have improved investor sentiment. However, uncertainty remains around certain expiring tariff exemptions, which could introduce short-term market volatility.

In the U.S., the latest labor market report showed better-than-expected job growth and a decline in unemployment. This data reduces the chances of aggressive interest rate cuts, which has momentarily slowed Bitcoin’s rally due to a stronger U.S. dollar.

🏛️ Regulation Could Define the Next Move

Regulatory clarity is expected to be a major theme in the coming weeks. Lawmakers in the United States are preparing to review several important crypto-related bills. These include proposals addressing central bank digital currencies (CBDCs), stablecoins, and general regulatory frameworks. A clearer legal environment could further attract conservative institutional investors.

📊 Price Action and Technical Levels

Bitcoin is currently trading near $109,000 after breaking out of a prolonged consolidation range. Technical indicators remain supportive of further gains:

-

The Relative Strength Index (RSI) is neutral-to-bullish.

-

A bullish MACD crossover suggests momentum is returning.

-

If BTC holds above key support near $108,000, a retest of its all-time high near $112,000 is likely.

-

A failure to maintain support may lead to a pullback toward the $105,000 range.

🔮 Conclusion

Bitcoin’s strong close to Q2 reflects growing market confidence and institutional activity. While short-term risks remain due to macroeconomic shifts and regulatory uncertainty, long-term momentum appears intact. With projections pointing toward $200,000 and ETF flows remaining positive, BTC could be on the cusp of another historic rally.