-

Current price movement: Pi (PI) is trading slightly lower at around $0.45, continuing a recent trend of downward pressure.

-

Whale activity spotted: More than 2 million PI tokens have been moved from exchanges to private wallets, indicating accumulation by large investors.

-

Bearish momentum: Technical indicators show weakening strength, suggesting the possibility of a drop toward the $0.40 support zone.

Whale Moves Signal Confidence Amid Sell Pressure

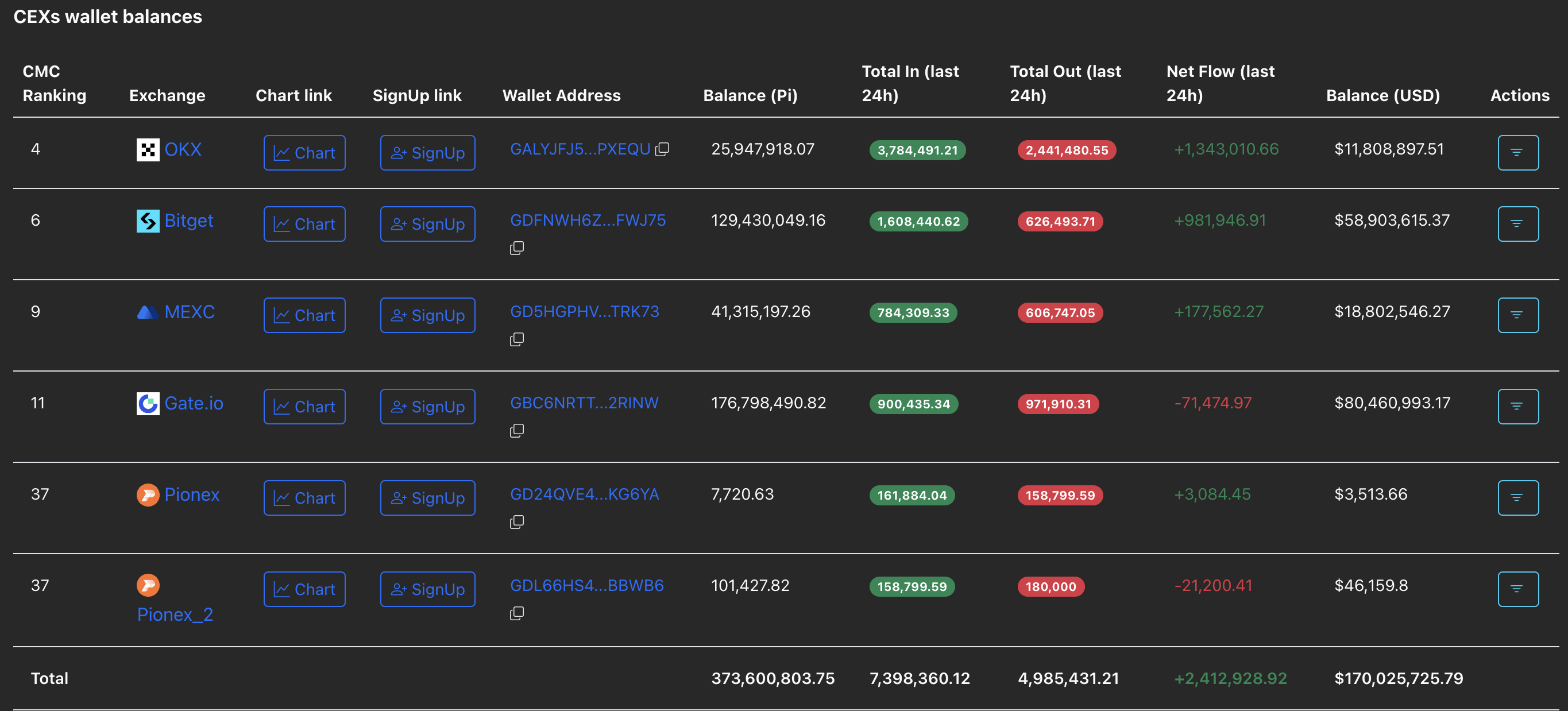

While overall exchange reserves have increased — now holding over 373 million PI — a closer look at on-chain data reveals a different story. A few large-scale withdrawals have occurred recently, with one address transferring approximately 1.66 million PI, and another withdrawing 400,000 PI from a major trading platform.

The larger of these wallets has been actively accumulating in recent days, building up a position close to 8 million PI. This accumulation appears to contrast with the general rise in exchange supply, potentially indicating strategic buying by well-informed holders.

Price Analysis: Bears in Control, But Not Without Resistance

Pi has dropped about 12% over the last seven days, pushing its value back toward the $0.40 range last seen in mid-June. Technical signals are mostly bearish at this stage:

-

Relative Strength Index (RSI) is hovering around 33, indicating the token is approaching oversold territory. A further dip could invite more selling pressure.

-

MACD (Moving Average Convergence Divergence) is currently in the negative zone, though some histogram contraction hints that bearish strength might be weakening.

Price Zones to Monitor

-

Immediate support: Around $0.40. If bears maintain control, this is likely the next major test.

-

Short-term resistance: The $0.50 level remains a psychological barrier. A breakout above this point could lead to a short-term rally toward $0.54, a level seen in late June.

Conclusion

Despite the increase in exchange reserves, the transfer of over 2 million PI into private wallets by large holders suggests that some investors are taking a long-term view. While the technical picture still points downward, this accumulation could provide a foundation for a potential reversal — especially if price action can break back above the $0.50 threshold in the days ahead.